Facebook is rolling out its WhatsApp payment service for users in India after receiving approval from the country’s regulators. The service first launched in India as a beta in 2018, but a full rollout was delayed for years by concerns about data storage and sharing. It’s an important launch for what is WhatsApp’s biggest market, home to some 400 million users.

India’s regulatory body for retail payments, the National Payments Corporation of India (NPCI), gave its approval to WhatsApp on Thursday, with Facebook confirming the rollout of the service just hours later in a blog post. The news was significant enough for Facebook CEO Mark Zuckerberg to create a video (embedded below) explaining some of its features.

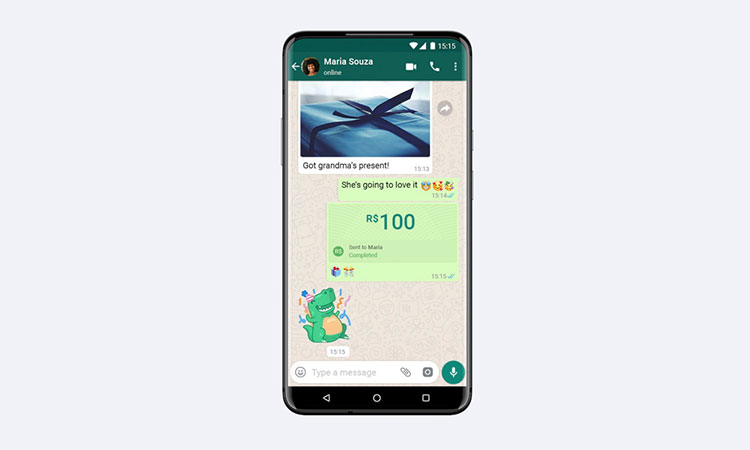

“Now you’re going to be able to easily send money to your friends and family through WhatsApp just as easily as sending a message,” said Zuckerberg. He also suggested that digital payments were “especially important” during a global pandemic, as they eliminate the need for the in-person exchange of cash.

WhatsApp’s payment system will use India’s national payments infrastructure, known as the Unified Payments Interface or UPI. This allows interoperability between different apps and is also used by Walmart’s PhonePe and Google Pay, two of the largest UPI mobile payments providers in the country, with both controlling around 40 percent of the market.

But digital payment providers in India will face new challenges in the months ahead. As reported by TechCrunch, the NPCI also announced this week that it would be capping the amount of UPI transaction any single service can process to “[protect] the UPI ecosystem.” In future, no one service will be allow to process more than 30 percent of the total volume of UPI transactions, but it’s unclear how these limits will be enforced.

WhatsApp will take a while to hit these limits, though the NPCI made it clear it will be reining in the Facebook-owned payment service from the get-go. The regulatory body said WhatsApp would only be allowed to launch the service in a “graded” manner, starting with “a maximum registered user base” of 20 million UPI customers.

In a blog post, Facebook said it had worked with five “leading banks” on its new payment service: ICICI Bank, HDFC Bank, Axis Bank, the State Bank of India, and Jio Payments Bank. UPI itself is supported by more than 160 banks.

The Verge is an ambitious multimedia effort founded in 2011 to examine how technology will change life in the future for a massive mainstream audience.

Our original editorial insight was that technology had migrated from the far fringes of the culture to the absolute center as mobile technology created a new generation of digital consumers. Now, we live in a dazzling world of screens that has ushered in revolutions in media, transportation, and science. The future is arriving faster than ever.